Buy vs. Rent

The New York Times has a fascinating Flash-based Buy vs Rent calculator that is much more interactive and detailed than any other calculators I have seen on the web.

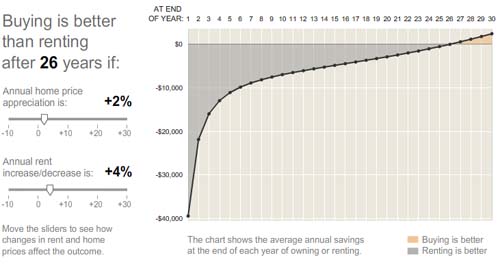

If I plug in the numbers I'm currently considering and leave all the interest rates at their defaults, I get the surprising result that buying is better than renting only after 26 years, with a net difference at the end of $72,000:

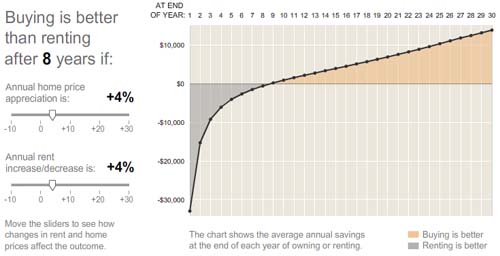

But, switching the "Annual home price appreciation" from 2% to 4%, it's better to buy after only 8 years, and the net difference is $400,000:

In other words, which is better is so completely dependent on what the market does over the 30 years that it's hard to make any good predictions. So despite playing around with the calculator a whole bunch, I'm still at square one in terms of my decision.

One interesting thing I did note is that changing the down payment percentage has almost no effect on the final result, because this calculator accounts for all the opportunity costs (that is, it assumes that you will invest the money you save by renting in the stock market). So in terms of the final net result, there's no reason to make a bigger down payment if you have the money, because you'd be just as well off investing that money in the stock market instead. Similarly, it seems to follow that there's no reason to wait a few years and save up for a bigger down payment, since at that point you would have the same choice (though I have not thought this one through completely). Obviously this doesn't account for other non-strictly financial benefits of having a large down payment, such as the lower risk in case something goes wrong.

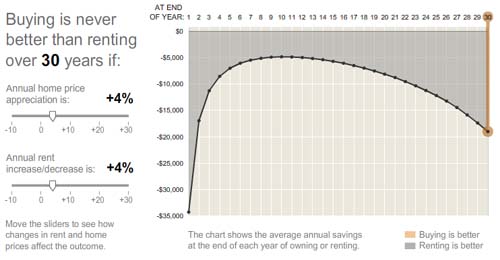

By default the calculator assumes a 5% rate of return on investments, which is a pretty low estimate - that's what I get on my regular savings account, in the long-term the stock market will average much better. If we change it to 10% (not unreasonable), we get this fascinating graph which says that buying is always worse than renting, and after 30 years a renter would have $570,000 more in the bank:

Twiddling with the home appreciation price slider at this point leads to wildly different graphs, so it's obviously impossible to make any good conclusions from it.

If anything, what I'm taking away is that renting is not necessarily that bad of an option compared to buying (despite what the real estate & mortgage industries would tell you), and that renting for one more year will not make a huge difference in the long run - who knows where I will be in a year, it's entirely possible (though improbable) that I could be married and thus be looking for a completely different type of house. Hrm..

April 22nd, 2007 - 10:11

I’m not sure if I agree with the graphs for one reason: equity. Do they take that into account? In your last graph, after 30 years of paying the mortgage, the buyer owns a house outright. Is that counted?

Doesn’t the last graph also assume that you invest all money that you save when renting?

For me, my mortgage was barely any more than I was paying in rent when I first got it, so probably by now I am paying less for my mortgage than I was for rent. I was finding it hard to justify paying out a certain amount every month, never to see any return on that money.

April 22nd, 2007 - 11:26

Yes – the graphs take that into account and assume that you sell the at the end for the market price when comparing how much money you would have. And yes, it assumes that you invest all the money you save by renting.

Probably the reason it comes out like this is that I plugged in Seattle numbers, where buying is about twice as expensive as renting ($350000 for a small condo). If we plugged in Colorado-style numbers where maybe buying costs about the same as renting, it might come out completely differently.

April 22nd, 2007 - 22:45

Ah, OK.

My current house costs about 10% more in mortgage payments than my apartment did. However, I moved to a new area right before house prices started to go up. Even so, my mortgage would probably only be 25% more than my rent if I had moved in this year.

April 23rd, 2007 - 12:32

Somebody gave me the wise advice that, in the end, I should buy a place if I really wanted to own a place, but to rent otherwise. So far, I agree. As long as you’re good about putting aside money to invest, the investment is never going to have a big impact on your life. But being tied to a place for a certain amount of time has a huge impact.

May 1st, 2007 - 21:49

I really wish more people would use these calculators…. too many people think that owning a house is the path to big $$$. The average real estate rate of return post-WWII in the US is 1% after inflation, and most of the recent runup is only since 1995. Of course, certain housing markets heat up and the like, but the same is true with, say, certain sectors of the stock market.

Not to mention that renters like myself pay to subsidize already well-off home owners via mortgage interest deduction and capital gains exclusions, which just arbitrarily inflate house prices and thus ultimately the rent that renters pay as well.

Of course this only works out if people are diligent about saving and investing money that they would otherwise be shoveling blindly into a house.

May 2nd, 2007 - 19:11

If you’re planning on staying in the area, think about it in terms of investment… rather than putting your money into rent, which you can get no return on in the future, put it into a condo/house. We bought our condo in a new development, Reunion (by DIA), and we’re predicting a good return on it when we’re ready to sell or rent it out.